|

contents | software | |||||||

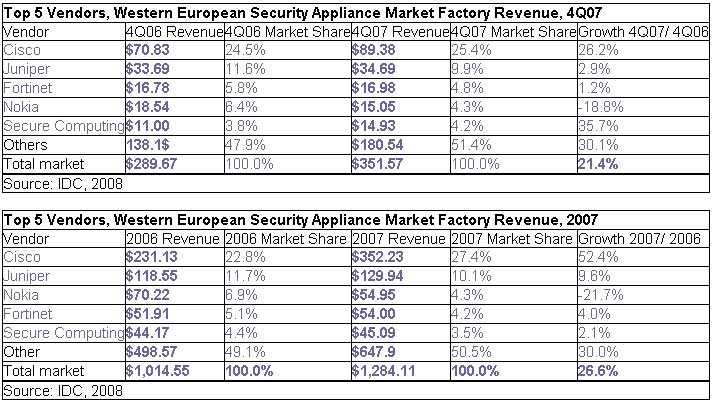

| IDC: UTM and Content Management Drive Strong Results for Western European Quarterly Security Appliance Tracker in 4Q07 According to IDC's Western European Quarterly Security Appliance Tracker, 4Q07 was the 11th quarter of consecutive positive growth for the Western European security appliance market, with revenues of $351.6 million, a 21.4% increase over the same quarter a year ago. For full 2007, the security appliance market revenue totaled $1.3 billion, representing 26.6% growth over 2006. According to Romain Fouchereau, research analyst at IDC, "The Western European security appliance market performance in 2007 was boosted by strong demand for unified threat management (UTM) and content management - messaging and Web security - appliances. 2007 has seen a noticeable growth in higher-end UTM solutions, validating IDC's view that UTM appliances are now seen as a valid security solution in the enterprise market. As for content management solutions, IDC believes that the appliance form factor will continue to become the platform of choice over software, following the same pattern seen in network security." The firewall/VPN market represented $91.6 million in 4Q07, a 7.8% increase over last year's 4Q. The firewall/VPN market is becoming more mature in Western Europe, explaining the slow growth for this workload. This is also due to the fact that vendors are increasingly moving away from offering traditional firewall/VPN appliances and are starting to offer UTM solutions instead. Cisco remained the number 1 vendor in the segment, followed by Juniper Networks. UTM represented the largest market of the tracked security appliances, with total revenue of $114 million in the last quarter, corresponding to almost 25% growth over 4Q06. Unified threat management appliances are proving more and more popular in Western Europe and have moved from a typical remote/branch-office solution to the core of the enterprise. Fortinet was the market leader, followed by Netasq and Cisco. IDS appliances revenue reached $11.4 million in 4Q07, a 5.2% growth over 4Q06. This market will cease to grow due to the shift towards IPS solutions. IPS grew 16% over last year's final quarter, representing a $71.3 million market. IPS growth is driven by compliance (the best example being the PCI industry), and IDC believes that with more and more compliance issues coming to Europe, IPS solutions will continue to increase. UTM appliances and integrated IPS solutions will nevertheless slow this growth, as they continue to gain credibility as a valid security solution in the enterprise market. Cisco was market leader in both the IDS and IPS markets, followed by Nortel for IDS and IBM-ISS for IPS. Content management appliance revenue grew by 54% year on year, reaching $63.3 million in 4Q07. The messaging security and Web security segments of SCM are following the same evolution of the threat management market, from software to appliance form factor. Given the fact that security appliances can lower costs, ease administrative overheads, facilitate management, consolidate support, scale efficiently, and integrate multiple security technologies into a single platform, their success is not surprising in the SCM market. IronPort remained the number 1 vendor in the content management appliance segment and the messaging security subcategory. Secure Computing led the Web security appliance market, while McAfee dominates the Web and messaging subcategory.  IDC's Quarterly Security Appliance Tracker offers the ability to quickly and effectively respond to today's dynamic security server appliance market by keeping pace with evolving functionality and the rapid deployment of new models competing in the marketplace. The product provides insight into customer trends by delivering geography-specific product line and vendor market share information in an easy-to-use product interface, enabling quick table customization for business planning activities. write your comments about the article :: © 2008 Computing News :: home page |