|

contents | business | |||||||

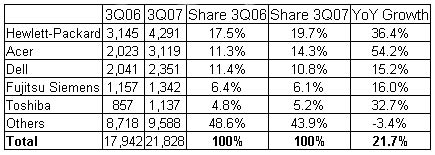

| Strong Back-to-School and Continued Notebook Momentum Boosts EMEA PC Market Growth to 21.7% in 3Q07, Says IDC Boosted by continued buoyancy in the notebook market and a very active back-to-school season for most vendors, PC shipments in EMEA rose by 21.7% in the third quarter of 2007 compared with the same quarter last year, reaching close to 22 million units, according to preliminary data released today by IDC EMEA. Notebook shipments exceeded expectations, recording over 45% growth year on year while desktop sales came in line with forecasts at a more modest single-digit rate. Driven by a buoyant back-to-school season in Western Europe, fierce vendor competition between the major players and accelerating notebook demand in Central Eastern Europe, portable PC sales continued to display outstanding growth trends across most countries. Demand for notebooks continued unabated as vendors deployed extremely attractive promotions in the retail channel and as average prices continued to decline, stimulating first-time purchases or replacements. "Particularly in Western Europe, replacement demand and multi-equipment homes have become key drivers of growth across the region", said Eszter Morvay, senior research analyst for IDC's EMEA PC group. "With notebook prices starting as low as ?299 or ?399, consumers benefit from very attractive retail deals, fuelled by intensifying competition between vendors as well as rising pressure from alternative channels, in particular etailers. Despite continued price erosion, specifications of notebooks have increased significantly, further narrowing the price/performance ratio to desktops. The vast majority of the market has now shifted to dual-core and 15.4in wide-screen, but thanks to declining prices, the 17in. segment is also enjoying strong growth and is expected to expand further in the Christmas season." "Demand for notebooks also continued unabated in the CEMA region, boosting the share of the region to 37.4% of overall PC shipments in EMEA", said Stefania Lorenz, research director for IDC CEMA Systems. "While desktops continued to report healthy growth, notebook sales recorded another outstanding increase across the region at close to 80% and 60%, respectively, in CEE and MEA. The stable economic environment across the region led to increased household purchasing power, which in turn resulted in growth of PC sales. The continued commitment of international vendors to increasing resources - new offices, larger sales forces, local assembly, and strong marketing - contributed to market expansion. Demand for notebooks in the consumer market boosted retail sales, with new shopping malls and hypermarkets allowing international brands to expand geographically with retail partners." Business sales also displayed healthy trends across EMEA and contributed to assist overall market performance. SMB demand for notebooks continued to display strong trends thanks to the renewal of a large installed base and a growing market in CEMA. The corporate market is also picking up as expected in Western Europe, while several tenders drive continued growth in CEE and MEA across all product categories. This quarter did not suffer any major supply shortages, but as volumes continue to increase, the market is likely to be increasingly constrained in the run up to Christmas, in particular for displays and batteries, and while overall production is being increased and should therefore enable the largest players to meet demand, it may be to the detriment of smaller vendors which could face sourcing difficulties. "While demand is not expected to soften in 4Q and throughout 2008, as portable adoption and renewals fuel consumer sales and business refreshes drive sustained growth in the commercial space, the market is undoubtedly becoming more challenging", said Karine Paoli, director for IDC's EMEA PC group. "Price erosion will continue as a result of intensifying competition between the players, forcing vendors to constantly refine their business models to address each market segment effectively and better balance their portfolio. While this year has been marked by clear movements within the industry, one can expect market consolidation to potentially continue over next year, as global scale and supply chain optimization will increasingly be critical." Vendor Highlights: HP continued to gain share and reinforce its leadership in EMEA, with a solid 36.4% growth in overall shipments. A very strong and well prepared back-to-school season for the vendor enabled outstanding growth in notebook shipments of over 70%, while the vendor continued to deploy effective marketing and strategies in the SMB and corporate markets, contributing to drive the vendor's commercial sales too. Acer also recorded a very strong back-to-school season and regained second position in the overall ranking this quarter. The vendor continued to drive very active marketing and promotional campaigns along with a strong notebook product line up in the retail sector, which assisted continued share gains in the consumer and SMB markets and boosting sales in the CEE region, while the vendor also continued to grow share for desktops. Dell maintained key positions in the commercial space, and the launch of new notebooks assisted healthy portable growth. The introduction of the new Vostro line for the SMB segment and repositioning of its Inspiron range for the consumer market have marked the first stages of the vendor's redefined strategy. The first initiative with Carphone Warehouse in the U.K. outlines the vendor's ambitions to tackle the consumer opportunity more effectively. Fujitsu-Siemens recorded healthier results overall, at 16%, after a slower first part of the year. Despite fierce competition the vendor maintained a healthy performance in the notebook market thanks to increased competitiveness and active channel programs, while maintaining key positions in the corporate market in Germany and continued growth in CEE and MEA. Toshiba maintained fifth position in the overall EMEA ranking, holding well in the notebook space, albeit slightly below overall market growth as the vendor faced tough competition from the leaders across the entire region. The vendor also continued to expand and display a strong performance in the CEE and MEA regions. Lenovo and Asus maintained their sixth and seventh positions, respectively. Lenovo continued to perform well in the commercial space across both desktop and notebook form factors, while Asus continued to post outstanding growth and took fifth position in the EMEA notebook market. And this quarter saw the rise of Samsung, which entered the Top 10 notebook ranking in tenth position thanks to a major boost of its sales across the region. Top 5 Vendors: Europe, Middle East, and Africa (EMEA) PC Shipments* Third Quarter 2007 (Preliminary) (000 Units)  Source: IDC EMEA, Preliminary Results, 3Q07, October 18, 2007 *PC shipments = Desktop and Notebooks. Shipments are branded shipments for all form factors (including desktop and notebooks) and exclude x86 servers as well as OEM sales for all vendors. Data for all vendors is reported for calendar periods. write your comments about the article :: © 2007 Computing News :: home page |